tn franchise and excise tax manual

Web 2 Page Contents Chapter 1. Ad Access Tax Forms.

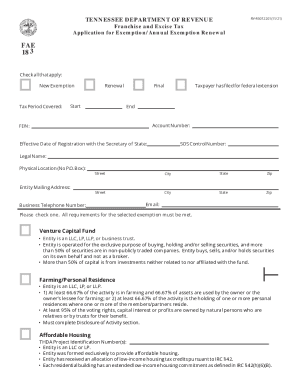

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller

Web FONCE-1 - Qualification and Filing Requirements for the Family Owned Non-Corporate Entity FONCE Exemption.

. Web 2 Page Contents Chapter 1. The book value cost less accumulated depreciation. FONCE-4 - The FONCE Exemption When No Income Was Generated.

Download Or Email FAR 183 More Fillable Forms Register and Subscribe Now. Web Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121. Web 2 Page Contents Chapter 1.

The minimum tax is 100. FONCE-3 - Entity Types That May Qualify for the FONCE Exemption. All entities doing business in Tennessee and having a substantial nexus in.

F. Web In general the franchise tax is based on the greater of Tennessee apportioned. Web Tennessee State Government - TNgov.

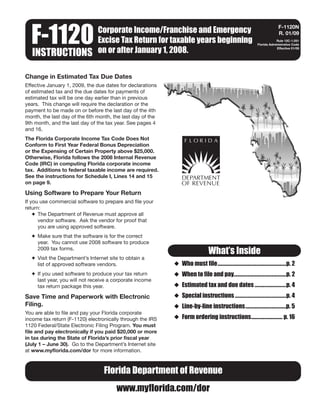

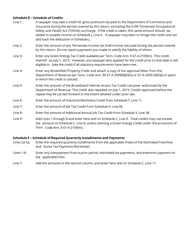

Web 2 Page Contents Chapter 1. Web 2 Page Contents Chapter 1. FE Credit-4 - Gross Premiums Tax Credit.

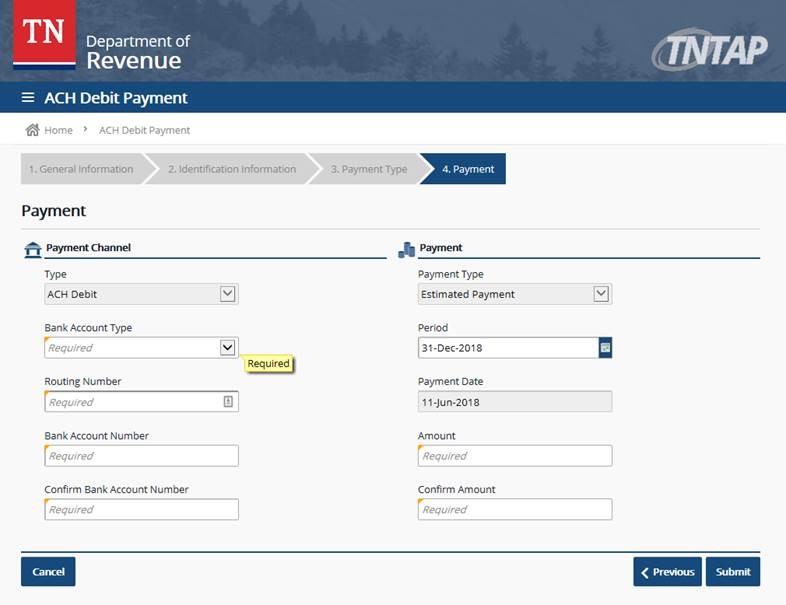

Web 2 Page Contents Chapter 1. Web Quarterly payments of estimated franchise and excise tax are made according to the schedule below. F.

Tax credits offset tax liability. Web 2 Page Contents Chapter 1. Web Franchise Excise Tax - Credits.

Web The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years. F.

Web Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. Web All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the. For more information view the topics below.

Complete Edit or Print Tax Forms Instantly. The term quarterly is used because there are four payments due. Net worth assets less liabilities or.

FONCE-2 - Relationships That are Considered Family Members for the FONCE Exemption. Web Tax manuals are intended to be a more comprehensive resource for taxpayers who wish to gain a better understanding of Tennessees mostly commonly applicable taxes. Web 2 Page Contents Chapter 1.

Tn Dor Fae 183 2021 2022 Fill And Sign Printable Template Online

Llc Cost In Tennessee How Much To Pay For An Llc

Tn Posts Updated F E And Business Tax Manual Nfib

Fae 170 Fill Out Sign Online Dochub

Franchise Excise Tax Obligated Member Entities Youtube

State Corporate Income Tax Rates And Brackets Tax Foundation

Critical Social Justice In Tennessee Higher Education An Tennessee Pdf4pro

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tennessee Cpa Journal May June 2015

Instructions For Preparing Form F 1120 For 2008 Tax Year R 01 09

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tennessee Annual Report Filing File Online Today Zenbusiness Inc

Fill Free Fillable Forms State Of Tennessee

2020 Final Wrap Of 111th General Assembly Tennessee Senate Republican Caucus

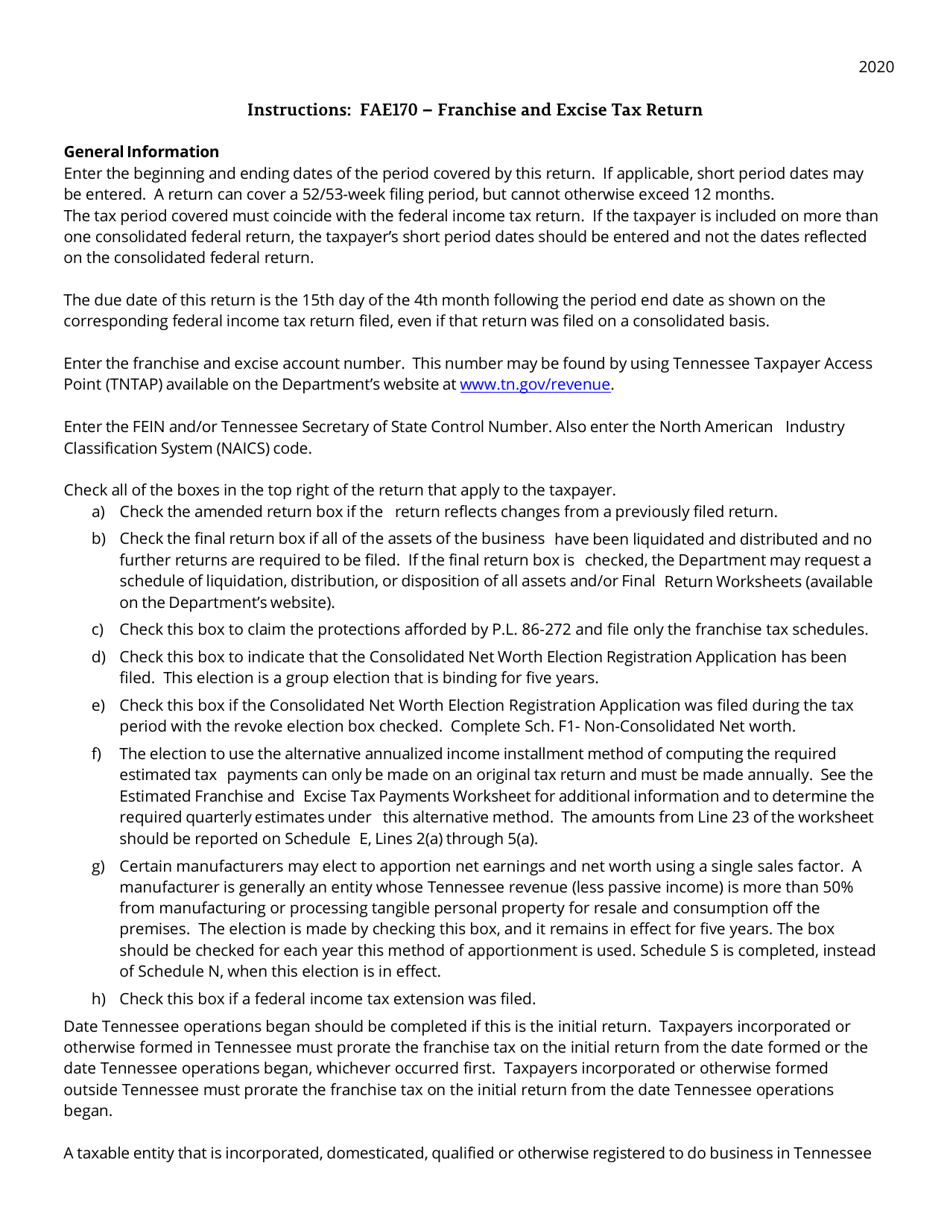

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

Tn Fae 170 Instructions Form Fill Out And Sign Printable Pdf Template Signnow

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas